The 2019 San Francisco Health Care Security Ordinance was put in place to protect workers and ensure that everyone has access to health care coverage.

For business owners, compliance is mandatory. However, how you choose to spend the required health care investment is up to you.

At Innovative HIA we provide affordable solutions for companies seeking to comply with the ACA and SF-HCSO.

What is SF-HCSO & What Do Business Owners Have to do to Comply?

The Health Care Security Ordinance is a San Francisco law that requires employers with 20+ employees in San Francisco to:

- Satisfy an Employer Spending Requirement by making health care expenditures on behalf of their employees.

- Maintain records to establish compliance with the ESR.

- Submit an Annual Reporting Form by April 30th of each year.

Covered Employees are:

- Those that work in the geographic boundaries of the city and county of San Francisco.

- Those that have been employed at least 90 calendar days.

- Those who work at least 8 hours per week.

Non-Covered Employees are:

- Owners.

- Those with coverage through another employer who waive their rights to coverage on the Voluntary Waiver Form.

- Employees earning more than $100,796 annually.

- Those eligible to receive benefits under Medicare or TRICARE/CHAMPUS.

- Those who receive health care benefits pursuant to the San Francisco Health Care Accountability Ordinance (HCAO).

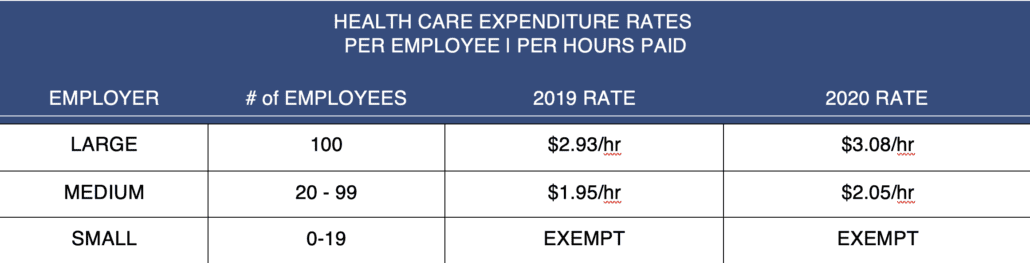

Minimum Health Care Expenditure depends on the size of the employer. It is calculated by multiplying “hours paid” by the rate listed below.

“Hours paid” includes hours an employee is paid for work, as well as paid vacation, PTO, and sick leave as long as the hours are worked in San Francisco.

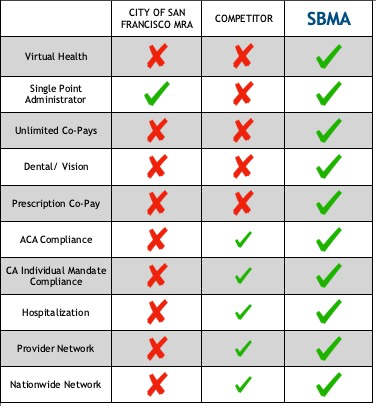

We ensure easy administration and enrollment in the SF-HCSO coverage options with Innovative Health Insurance Advisors and our TPA, SBMA

EMPLOYER OPTIONS

Option 1: Pay for Major Medical.

- Companies with major medical opt outs, part time, and seasonal employees still have to pay the city or take another Limited MEC, ACA Compliant plan. With an average of $200 – $300 /employee/ month major medical is unaffordable or doesn’t meet the spend requirement to the penny.

Option 2: Pay the city.

- * NOT ACA Complaint Does not satisfy MEC CA Individual Mandate.

- Employees in the city limits (Most employees live outside the city) can get the “city option” though it has few doctors and hospitals in the city.

- Employees outside the city cannot get the “city option”. Money is put into a Medical Reimbursement Account (MRA) +- $2000-$3000/yr/employee.

- Employees pay full price (No in-network discount) at the doctor and pre pay. Reimbursement takes 2-3 weeks. If funds are not used within 2 years, money can be swept by the city. There are no commissions paid to the broker.

Option 3: Enroll in the Innovative Health Insurance Advisors option.

- *ACA compliant MEC satisfies CA Individual Mandate.

- Limited Medical plan includes Office Visits, Telemedicine with $0 copay, RX, Lab/X-ray, ER, Hospital, Surgery, Full Dental Plan.

- Plan uses the nationwide PHCS Network. 10,000+ Doctors, 13 Hospitals within 20 miles of the city.

- Simple Spreadsheet Enrollment

- MultiPlan PHCS Network with approximately 10,000 Doctors within 20 miles of central San Francisco.

- Co-pay Rx Prescription coverage through SmithRx.

ACA & The Personal Mandate

Employer Affordable Care Act (ACA) Compliance

If you are a US employer with 50 or more full-time employees, you must comply with the Affordable Care Act (ACA) which states that employers must offer minimum essential coverage (MEC) to all employees

California’s Individual Mandate Shared Responsibility Tax Penalty.

The new individual mandate for Californians requires every resident be enrolled in, and maintain, minimum essential coverage for each month beginning on or after January 1, 2020. The penalty for Californians who go without health insurance may be 2.5% of household income or $695 per adult, whichever is larger.

*According to Covered California

COMPARISON OF Benefit Plan Offerings