Why is Offering MEC Benefits More Affordable Than Not?

Article originally published on SBMA Benefits.

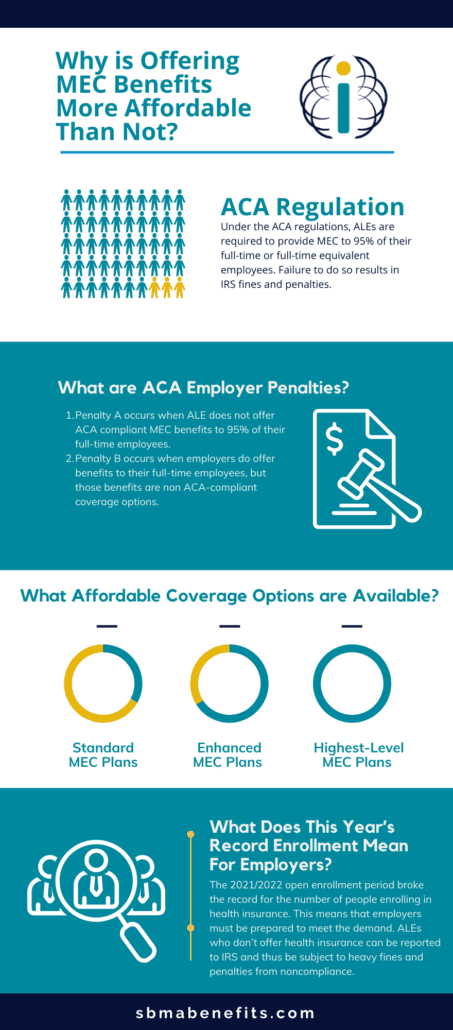

The Affordable Care Act (ACA), created in 2010, was designed to ensure healthcare is affordable and available to more people. Under the ACA regulations, applicable large employers (ALEs) are required to provide minimum essential coverage (MEC) to 95% of their full-time or full-time equivalent employees (someone who works at least 30 hours per week). Companies who qualify as ALE have at least about 50 full-time employees in a calendar year.

If you fail to provide minimum essential coverage to 95% of your full-time employees, your company will be subject to various penalties that could cost your business. If you do a cost-benefit analysis, investing in MEC for your employees can save you millions, while also increasing employee engagement.

How Do You Determine Employee Benefit Eligibility?

There are two methods for ALEs to determine employee benefit eligibility. They include the following:

- Monthly Measurement Method

- Look Back Measurement Method

In the monthly measurement method, an employer must count the total hours each employee worked per calendar year. If they worked for more than 130 hours in one calendar year, they are automatically considered an employee who should be eligible for employer benefits.

On the other hand, the look back measurement method looks at the employee’s future employment status to determine benefit eligibility. It assesses the stability period and the predicted hours the employee will work monthly.

Both methods help employers calculate benefit eligibility to avoid fines for failing to offer federally mandated benefits to their workforce.

Other advantages of offering ACA benefits include:

- Providing affordable health insurance to your workforce

- Placing an emphasis on preventative care to maintain a healthy workforce

- Improving health care delivery

What are ACA Employer Penalties?

ACA employer penalties are fines issued by the Internal Revenue Service (IRS) to noncompliant ALEs. The IRS takes non-compliance seriously and is issuing higher penalty amounts according to the ACA times.

The two penalties they can issue are Penalty A and Penalty B. ALEs will receive one or the other, not both simultaneously.

PENALTY A

Penalty A occurs when ALE does not offer ACA-compliant MEC benefits to 95% of their full-time employees along with their dependents. The IRS will issue a fine for every full-time employee, excluding the first 30 employees, who are not offered ACA benefits. Fine amounts vary depending on the tax year IRS penalizes. The 2021 tax year penalties will be $2,700.

PENALTY B

Penalty B occurs when employers do offer benefits to their full-time employees, but those benefits are non ACA-compliant coverage options. Fines issued for Penalty B are $4,060 per employee for the 2021 tax year for ALEs who issued non-compliant insurance options.

These fines aren’t worth the monetary financial burden of failing to provide ACA-compliant MEC benefits to your employees. Continue reading to learn about the affordable coverage options available to you as an employer, and how much you will save by providing MEC benefits.

What Affordable Coverage Options are Available?

Employers seeking to provide affordable benefit coverage options for their employees have the opportunity to invest in ACA-compliant MEC benefits.

There are three different levels of MEC coverage options available. Knowing the difference between the three different plans helps employers decide which plan benefits their employees the most.

- Standard MEC plans are ACA compliant and include coverage for wellness, preventative services, prescription discounts, and telehealth services.

- Enhanced MEC plans take coverage one step further than standard plans and are aimed at attracting and retaining top talent by also including primary and urgent care visits with low copays, and discounted specialist and laboratory services.

- The highest-level MEC plans include the enhanced MEC plan benefits along with added coverage such as prescription coverage and low copays.

Investing in our ACA-compliant Minimum Essential Coverage (MEC) saves you money AND helps you hire and retain top talent in your company.

With 60% of employees vocalizing the importance of offering employee benefits when accepting a job opportunity, it’s important to understand the value benefits bring to your company. Read more on how benefits help employee retention here.

To help you see how much you actually save by providing our MEC benefits to your employees, we’ve broken down what you would pay in penalties by opting out of paying ACA-compliant benefits compared to our ACA-compliant MEC Benefit plan. Try out our functioning calculator by clicking the link here to see custom approximations for your business size.

For a company with 100 employees, providing our MEC Benefits plan can save you $187,820.39 a month, which calculates to over two million dollars in savings in one fiscal year. Reach out to our team of brokers to learn more about our benefits packages that work best for you and your company.

What Does This Year’s Record Enrollment Mean For Employers?

The 2021/2022 open enrollment period broke the record for the number of people enrolling in health insurance. Over 13.6 million people enrolled this season, slightly one million more than the previous record of 12.7 million in 2016.

Advisors attribute the record-breaking enrollment to increased government subsidies that help lower out-of-pocket costs for participants. This means that employers must be prepared to meet the demand. ALEs who don’t offer health insurance can be reported to IRS and thus be subject to heavy fines and penalties from noncompliance. Make sure your business is offering ACA-compliant insurance to avoid being reported.

Offering benefits helps keep your business away from paying IRS penalties. Penalties add up quickly and take away the opportunities you could have used the redirected funds for.

Did you know there’s another benefit to providing employees with benefits? With the Great Resignation becoming a very real workforce reality, employee retention should be top of mind for employers. Adding value to your business through employee benefits gives you as an employer an advantage in more ways than one. Read our article on how benefits improve employee morale here.